Payment Transaction Records

Transaction records overview.

Maximize the efficiency of your financial transactions with Ottu’s advanced Payment Transaction monitoring and management system. Unlock the full potential of your operations and gain unparalleled control over every transaction.

Ottu ensures a seamless experience for merchants by providing an easily accessible transaction table integrated with each installed plugin. This user-friendly feature grants merchants full visibility into their transaction history and details.

The transaction table in Ottu provides users with a seamless way to monitor all executed transactions, displaying essential details such as transaction ID, creation date, amount, and more. Merchants have the flexibility to customize the information shown on this table through the use of Proxy fields, allowing them to tailor the display to meet their specific needs. Additionally, a filtering option enhances the functionality by streamlining the search process, making it easier for merchants to quickly find specific transactions. This feature ensures that key transaction data is readily accessible and can be managed with ease.

To access the transaction table, simply navigate to the Transaction Tab located under each installed plugin.

Ottu enhances the merchant experience by providing a dedicated transaction table for each plugin, enabling seamless monitoring of transactions. With Ottu's innovative approach, merchants gain the flexibility to customize the transaction table's headers, allowing for quick and effortless access to the desired information. This empowering feature ensures merchants can efficiently navigate and retrieve the necessary details, optimizing their transaction management process.

From the Ottu Dashboard.

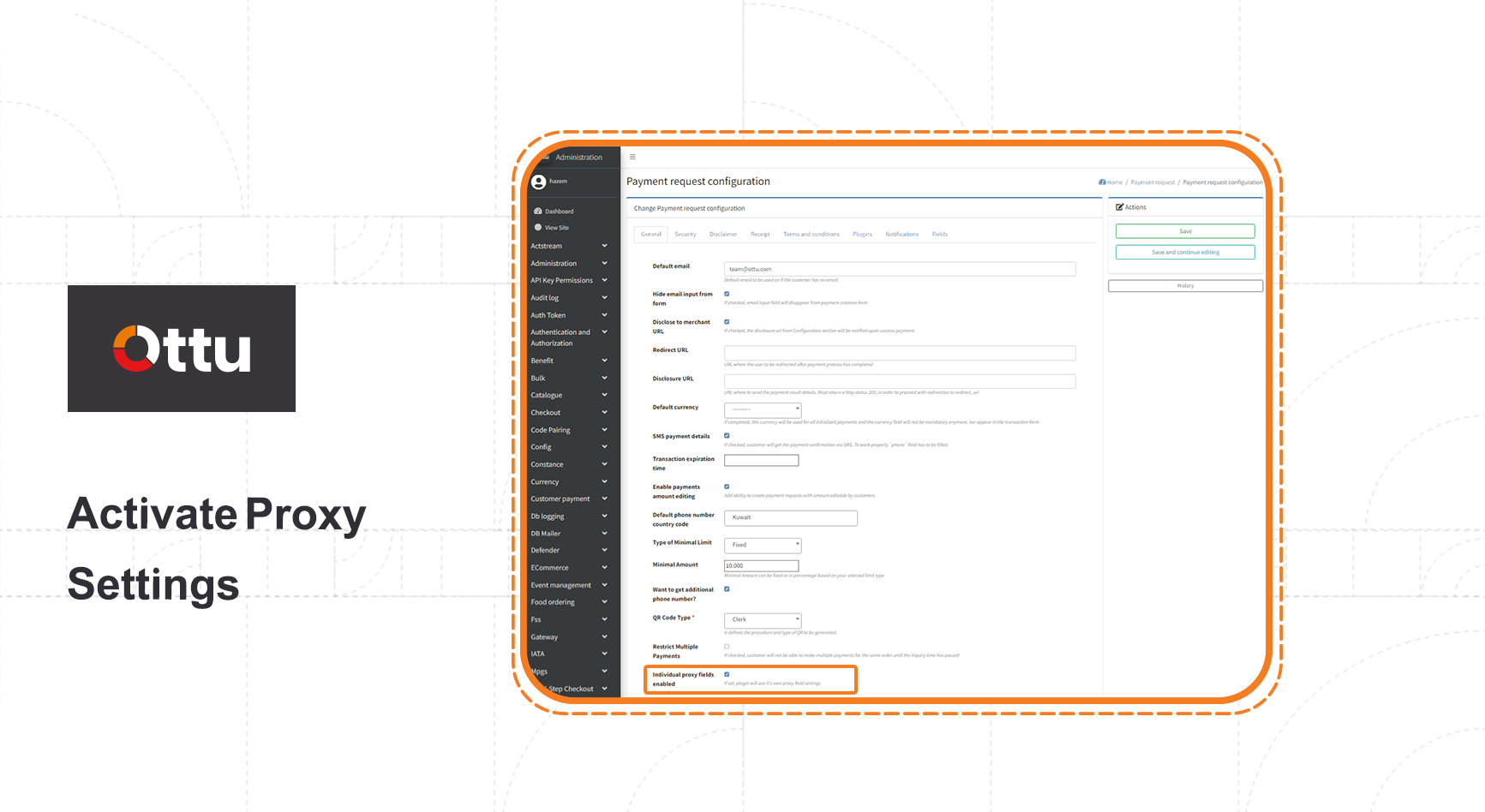

Navigate to the Administration Panel.

Access the Plugin Config for the desired transaction table.

Enable the Individual Proxy Fields option by ticking the checkbox.

To manage the headers, follow these steps:

From the Ottu Dashboard go to the Required Plugin Tab.

Access the Settings.

In the Table Headers section, you can add or remove headers by dragging them from the right to the left or vice versa (right ⇆ left). This dynamic empowers the merchants to customize the displayed headers according to their preferences.

Transaction tables offer the flexibility to add or remove multiple headers. Take a look at the proxy fields for more options. Amount headers are intelligently categorized under different titles, ensuring clarity on their specific roles within the payment process flow.

It is the initial amount when the transaction is first created.

It refers to the amount in the same currency as the initial amount.

For editable amount: It is the customer's entered amount at the checkout page. If the customer pays the full required amount, it will be equal to the initiating amount.

For non-editable amount: The settled amount remains the same as the initiating amount.

It is the amount that is transferred or credited to the merchant's bank account.

For purchase: It represents the settled amount, including the fee.

For authorize: It is the total amount captured by the staff.

The selection between Purchase and Authorization is typically determined within the payment gateway's operational configuration, specifically through the gateway settings (MID) operation configuration. This configuration governs whether the operation conducted is an authorization or a purchase.

It refers to the calculated difference between the initially specified Amount (what the customer was initially required to pay) and the Settled Amount (the actual amount settled or paid).

|Amount - Settled amount|

The fee refers to an additional amount that is added to the initiating amount, which the customer proceeds with.

Depending on the currency configuration of the merchant and the selected payment gateway (PG), fees may or may not be applied to transactions conducted in the default currency or foreign currency.

It refers to the amount that is sent back or returned to the customer's bank account, which is deducted from the paid amount.

It refers to the total transaction amount that is credited back to the customer's bank account upon completion of the rollback process.

It is applicable only for authorized payments that have not been fully or partially captured.

Capture: It can capture the entire amount, including the fee and settled amount.

Refund: It can only refund the settled amount (i.e., without the fee).

Void: It will nullify (or void) the entire amount, including the associated fee, if any.