Payment Notification

Payment webhooks are specific to payment events and are triggered on multiple occasions:

- Post-Payment Completion

Once a payer has completed the payment process and awaits redirection. To get notified for this event, the webhook_url must either be sent via the Checkout API when the payment transaction is created or set as the default webhook_url in the Ottu dashboard to apply for all transactions.

- Automatic Inquiry by Ottu

If a payment transaction has an associated webhook_url, it can be notified during the automatic inquiry process. This can happen immediately after the payer completes the payment process or later if the payment encounters an error. More details about the timings for automatic inquiry can be found here.

- Manual Notification by Staff

When a staff manually triggers a notification to the webhook_url from the Ottu dashboard.

- Merchant-Initiated Inquiry

When an inquiry API call is initiated by the merchant. Optionally, a notification can be sent to the webhook_url associated with the payment transaction or to a new one specified during the inquiry API call.

Configuring URLs:

Via Checkout API: Provide the webhook_url and an optional redirect_url when calling the Checkout API.

Using Plugin Config: Set the

webhook_urlandredirect_urlglobally via the plugin config, applicable to either E-Commerce or Payment request plugins. Even if these values are set globally, they can be overridden for specific transactions when using theCheckout API. For more details on this configuration, click here.

Endpoint Requirements: Ensure your endpoint adheres to all the stipulations outlined in the Webhook Overview. To review the requirements, click here.

Redirecting the Payer:

Successful Redirect: If you aim for the payer to be redirected back to your website post-payment, your endpoint should return an HTTP status of 200. Any other status will keep the payer on the Ottu payment details page.

Retaining on Ottu Page: If you intentionally want the payer to remain on the Ottu page post-payment, return a status code of 201. Ottu will interpret this as a successful notification, and the payer won’t be redirected. Any other status will be deemed as a failed notification by Ottu.

Specific Redirects: If you have a particular URL to which you wish to redirect the payer after the payment process, ensure you specify the redirect_url during the payment setup. Ottu will use this URL to navigate the payer back to your platform or any designated page post-payment.

A pre-established contractual agreement with the customer making the payment, allowing the merchant to securely retain and later use their payment details for particular purposes. This might include agreements like regular payments for services such as mobile subscriptions, payments in installments for purchases, arrangements for one-time charges like account reloads, or adhering to common industry practices such as penalty fees for missed appointments

Presence Condition:

The merchant should include it when creating the payment transaction, typically provided during the first payment setup within the auto-debit initiation process. It becomes a mandatory requirement when the payment_type is specified as "

auto_debit".

agreement child parameters

A unique identifier for the agreement

Presents if the payment amount can vary with each transaction.

Agreement starting date.

The final date until which the agreement remains valid.

The maximum debit amount for one billing cycle.

The number of days between each recurring payment.

The total number of payment cycles within the agreement duration.

Represents how often the payment is to be processed.

This is event-driven, with "recurring" as an example.

Seller information data including:

"name": "string","short_name": "string","category_code": "string"

Provides additional information for payment processing.

It includes the parameter "payment_processing_day" which provide information about the day of the month or a specific date when payment processing should occur, offering more control over the timing of payments.

In certain agreement types, the condition state becomes a required element. For further details on which parameters are mandatory for recurring agreements, please refer here.

Denotes the total sum of the payment transaction, which encompasses the cost of the procured items or services, excluding any supplementary fees or charges. See amount

The merchant should always check if the received amount from Ottu side is the amount of the order, to avoid user changing the cart amount in between.

Payment transaction due amount details

amount_details child parameters

The specified currency represents the denomination of the transaction. Nevertheless, it doesn't necessarily mandate payment in this exact currency. Due to potential currency conversions or exchanges, the final charge may be in a different currency. See currencies. 3 letters

Represents the total amount of the payment transaction, which includes the cost of the purchased items or services but excludes any additional fees or charges.

Denotes the comprehensive total of the payment transaction, incorporating both the principal amount and any associated fees. (amount+fee)

It indicates the sum disbursed by the customer in their chosen currency for the payment. Note, this currency could vary from the currency used for the transaction.

By enabling this, you will ask for user's address. If enabled, capture delivery coordinates should also be active.

Presence Condition:

The merchant should add it when setting up the payment transaction.

By enabling this, you will ask for user's delivery location on a map.

Presence Condition:

The merchant should provide it during the creation of the transaction.

It outlines the rules for a card's payment eligibility See the request parameter card_acceptance_criteria for more information.

Presence condition:

Any child parameter provided with the card_acceptance_criteria object in the request payload will be populated in the response as card_acceptance_criteria child parameter.

card_acceptance_criteria child parameters

Specifies the minimum required validity period, in days, for a card to be eligible for payment. If set to 30 days, for example, cards set to expire within the next month would be declined. This ensures short-lived cards nearing their expiration date are filtered out, reducing chances of payment failures. When implementing, balance merchant's operational needs with customer convenience. Setting it too stringent might increase payment declines, while a lenient approach could risk future payment failures.

Additionally, it defaults to 30 days when the payment_type is auto_debit. If any other payment type is selected, no default value is set.

The currency code of the payment transaction For more details, https://en.wikipedia.org/wiki/ISO_4217 3 letters code

Customer billing address data

Presence Condition:

The presence of each parameter is contingent on the provision of any selection of "customer billing address data" parameters during payment transaction creation.

The city where the customer is living and registered Max length: 40

The country where the customer is living and registered Based on ISO 3166-1 Alpha-2 code Validation will be performed against existing countries Max length: 2

Customer's street & house data Max length: 255

Additional data for accuracy purpose for line1 Max length: 255

Postal code. Max length 12 (it may have different length for different countries)

Where to pass the customer’s email address Have to be a valid email address Max length 128

Presence Condition:

It needs to be included when generating the payment transaction.

For the customer's first name Max length 64

Presence Condition:

The merchant should include it while making the payment of the transaction.

Customer ID is created by a merchant, and stored in the merchant database Max length 64

Presence Condition:

The merchant should include it during initiating the payment transaction.

For the customer's last name Max length 64

Presence Condition:

The merchant should include it while making the payment of the transaction.

Where to pass the customer’s phone number Max length 32

Presence Condition:

The merchant should include it when processing the payment for the transaction.

The extra information for the payment details, which the merchant has sent it in key value form.

Presence Condition:

The presence of the element will depend on whether the merchant includes it during transaction creation by adding each element from the plugin field configuration.

For example:

It represents a markup amount on the original amount. Max length: 24 Min value: 0.01

Presence Condition:

The merchant should add it in the currency configuration and include it during the transaction creation.

The code of the payment gateway used to proceed the payment Max length 16

The name of the payment gateway used to proceed the payment Max length 64

It will contain the raw payment gateway response sent by the payment gateway to Ottu.

Presence Condition:

It will only be present in response to the PG's callback request for the transaction.

This object contains information about the user who created the transaction from Ottu side, specifically, the user who generated the payment URL

Presence Condition:

It is present only when Basic Authentication is used, because API Key Authentication is not associated with any user.

Merchant includes the initiator ID in the payload when creating the transaction.

initiator child parameters

It represents the unique identifier of the user who performs the operation.

It represents the first name of the user who performs the operation. <= 32 characters

It represents the last name of the user who performs the operation. <= 32 characters

It represents the username of the user who performs the operation. Required. 150 characters or fewer. Letters, digits and @/./+/-/_ only.

The email address of the user who performs the operation. <= 254 characters

It represents the phone number of the user who performs the operation. <= 128 characters

Whether the transaction was carried out in a sandbox environment.

Presence Conditions:

It will only be present when PG's setting configured as sandbox

A message indicating the cause of a payment attempt failure., which is directly related to the payment attempt itself Max length 255.

Presence Condition:

It will only be present if a payment attempt records an error.

It is a specific code that is assigned to a transaction by the merchant. By assigning a unique identifier to each transaction, the merchant can easily retrieve and review transaction details in the future, as well as identify any issues or discrepancies that may arise. such like : ABC123_1, ABC123_2 Max length 128

Presence Condition:

It will be present only if

order_nohas been provided in the request payload.

It is the amount that is credited to the merchant's bank account Max length: 24 Min value: 0.01

Presence Condition:

It will only be present if a capture action is being processed on the transaction and the paid amount is recorded.

Enum: "one_off" , "auto_debit"

Type of payment. Choose one_off for payments that occur only once without future commitments. Choose auto_debit for payments that are automatically deducted, such as recurring subscriptions, installments, or unscheduled auto-debits. for more information about auto-debit API, please refer to Auto-Debit API documentation.

If auto_debit is selected:

agreement and customer_id parameters will also be mandatory.

Only

PG codessupporting tokenization can be selected. As a side effect, the card used for the payment will be associated with the suppliedagreement.id. This card will be locked, preventing the customer from deleting it from the system until an alternate card is chosen forauto-debitpayments

Ottu simplifies payment integration by standardizing inconsistent callback payloads from various payment gateways. Since transaction details like IDs, status codes, amounts, and timestamps vary in structure and labeling, merchants face challenges in processing this data reliably. Ottu extracts the essential details from any gateway’s payload and converts them into a unified pg_paramsobject, ensuring a consistent format that simplifies transaction management and integration.

Each parameter in pg_params represents a specific transaction-related attribute, stored as an object containing:

value: The actual data returned by the payment gateway.

verbose_name_ar: The Arabic label for the parameter.

verbose_name_en: The English label for the parameter.

pg_params child parameters

Authorization code assigned to the transaction.

A single string combining the card’s type, cardholder name, masked number, and expiration date as returned by the payment gateway.

The card’s expiration date in month/year format, as provided by the payment gateway.

Masked credit/debit card number used for the payment.

Type of card used (e.g., Visa, MasterCard).

Unique identifier assigned to the payment by the gateway.

Message from the payment gateway regarding the transaction status.

The date when the transaction was processed or recorded.

Reference ID used for transaction identification.

The final transaction status (e.g., Approved, Declined).

A tracking number for monitoring the transaction.

Unique identifier assigned to the transaction for reconciliation.

The name of the person to whom the card is issued.

The email address associated with the cardholder.

The month in which the payment card expires.

The year in which the payment card expires.

A combined field representing the card’s expiry month and year, typically formatted as MM/YY.

The financial institution or bank that issued the payment card.

A receipt number issued for the transaction, typically for reference purposes.

Another form of transaction identifier, possibly used for internal reference.

The final decision on the transaction, such as approved or rejected.

The amount in the payer’s currency under Dynamic Currency Conversion (DCC).

The currency used by the payer under Dynamic Currency Conversion (DCC).

The exchange rate applied when converting the transaction amount to the payer’s currency under DCC.

A unique reference number used to identify the transaction for retrieval or inquiries.

Example:

It is a unique identifier for the payment attempt, which can be used as a tracking identifier Max length 128

The payment amount paid back from the merchant to the customer. Max length: 24 Min value: 0.01

Presence Condition:

It will only be present if a refund action is being processed on the transaction and the refunded amount is recorded.

The amount remaining to be paid in the transaction. (amount – settled amount) Max length: 24 Min value: 0.01

Presence Condition:

It will only be sent if the editable amount option is turned on.

The result of the payment transaction attempt. Possible values: pending, success, failed, canceled, error, cod. Check the Attempt States section for more details.

Ottu unique identifier which gets generated when the transaction is created. It can be used to perform subsequent operations, like retrieve, acknowledge, refund, capture, and cancelation. Max length 128

Is the amount with the same currency of the initiating amount,

For editable amount: It is the amount that the customer enters at the checkout page

For on-editable amount: The settled amount is the same value as the original payment amount

Presence Condition:

It will be present only if the transaction is

paid,authorizedorcod.

A cryptographic hash used to guarantee data integrity and authenticity during client-server exchanges. This hash ensures that the API payload has not been tampered with, and can only be verified by authorized parties.

It represents the timestamp at which Ottu processed the transaction.While this often corresponds to the payment time,it's important to note that it might not always be the case.Payments can be acknowledged at a later time,so this timestamp might not align precisely with the actual payment time.

It is one of the Payment transaction state. And could one of the below: created, pending, attempted, authorized, paid, failed, canceled, expired, invalided, or cod. Max length 50

The ID of the transaction log associated with the transaction. Max length 32-bit String (2^31 - 1)

Presence Condition:

It will be sent only if the transaction type is BULK as it's a bulk identifier.

Represents token details.

Presence Conditions:

When user pays with a tokenized card, Ottu will include the token details in the response

token child parameters

The card brand (e.g., Visa, Mastercard) associated with the card. Display this information for customer reference.

Define if provided card token can be used to initiate auto debit requests.

The unique identifier for the customer who owns the card Max length: 36

Specifies if the card requires the submission of a CVV for transactions. A card without CVV requirement can be used for auto-debit or recurring payments

The card's expiration month. Provide this information for transaction processing and validation. Max length: 2

The card's expiration year. Provide this information for transaction processing and validation. Max length: 2

A boolean field indicating whether the card has expired. Use this information to determine if the card is valid for transactions and to notify the customer if necessary.

Transactions resulted to the PG operations performed on the parent transaction See child transaction sate

Presence Conditions:

It will be sent only if operations processed on transaction and resulted child transaction records.

transaction child parameters

The amount of child transaction object represented in transactions Array Must be positive Max length: 24 Min value: 0.01

The code represents the used currency. 3 letters

The order_no of child transaction object represented in transactions Array

The unique session identifier of child transaction object represented in transactions Array

The state of a child transaction object represented in transactions Array

The payment amount resulted by performing void operation Max length: 24 Min value: 0.01

Presence Condition:

It will only appear if a void action is being performed on the transaction, and the voided amount is documented.

Ottu notifies the webhook_url for all payment event types, not just success. This includes statuses like error, failed, pending, rejected, etc. The payload provides enough context to identify the status of the event.

Events like Refund, Void, or Capture are considered operation events and not payment events. If you’re looking for information on these, please refer to the Operation Webhook page.

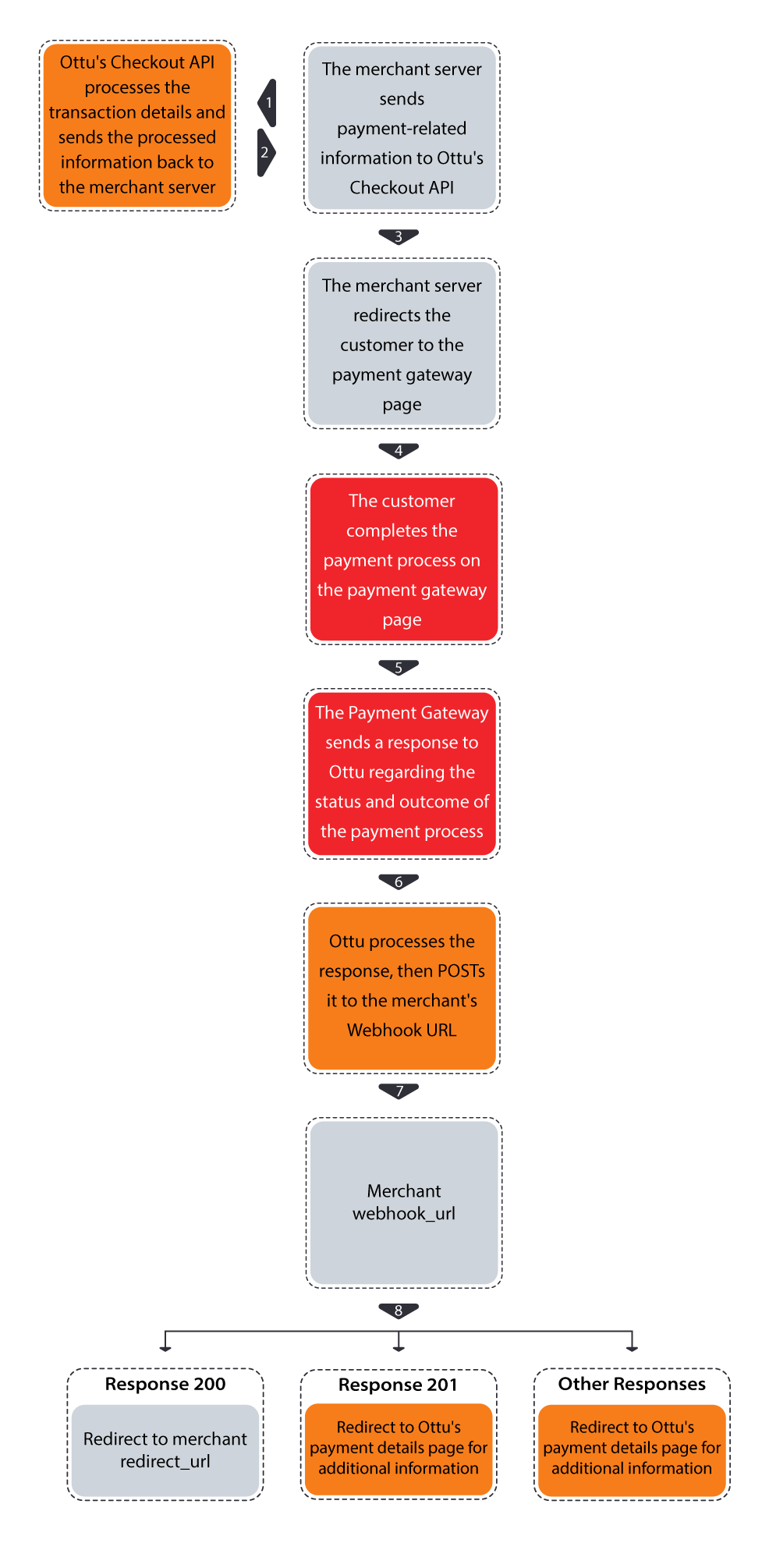

To ensure a smooth redirection of the payer back to the designated redirect_url, it is essential that the redirect_url is accurately provided during the payment setup. Additionally, the webhook_url must respond with a status code of 200. This specific status code serves as a confirmation of successful interaction between the involved systems, ultimately guaranteeing the seamless progression of the redirection process as originally intended.

Redirect behavior based on webhook_url response: - status code 200, the customer will be redirected to redirect_url. - status code 201, the customer will be redirected to Ottu payment summary page. - status code any other code, the customer will be redirected to Ottu payment summary page. For this particular case, Ottu can notify on the email, when Enable webhook notifications? Activated

When you receive a payment notification, it’s crucial to understand and acknowledge the payment’s status and details. Here’s how you can interpret the information:

1. Payment Events Types

There are several types of payment events you might encounter:

Payment: This indicates a direct payment transaction.

Authorization: This signifies a payment authorization, which might be captured later.

Cash (Offline): This represents an offline payment, often referred to as Cash on Delivery (COD).

2. Interpreting the result field

result fieldThe result field is your primary indicator of the payment’s outcome:

If the

resultissuccess, it means the payment was successful.If the

resultisfailed, it indicates an unsuccessful payment attempt.For cash payments, the

resultfield will becod, indicating Cash on Delivery.

3. Understanding the operation Field

The operation field provides insight into the type of transaction:

If the operation is

payment, it indicates a direct payment.If the operation is

authorization, it signifies a payment that’s been authorized but not yet captured.

4. Verifying the Amount

The amount field provides the value the customer has paid in the currency set during the payment setup.

However, the actual amount captured by the Payment Gateway (PG) might differ. This can be due to additional fees, currency conversion, or other factors. To get the exact amount captured by the PG, refer to amount_details.amount. The currency in which this amount is denominated can be found in amount_details.currency_code.

In most scenarios, cross-referencing with the amount field should suffice. But if there are discrepancies or if you’ve set up fees or currency conversions, it’s advisable to verify with

amount_details.

5. Cash Payments

For Cash on Delivery transactions, the result field will specifically be cod. This helps differentiate offline payments from online ones.

By understanding and interpreting these fields correctly, you can ensure accurate and timely acknowledgment of all your payments, be they online or offline.

In Conclusion, As you navigate the intricacies of Ottu’s payment webhooks, it’s paramount to ensure you’re well-acquainted with all the general guidelines. We strongly recommend reviewing our comprehensive Webhooks page for a holistic understanding. Additionally, if you find yourself with questions or uncertainties, our FAQ section might already have the answers you seek. We’re committed to ensuring a seamless experience, and your thorough understanding of our systems is a crucial part of that journey.

Last updated